What is Chit Fund?

Chit Funds are classified as miscellaneous non-banking financial institutions, or informally occur between friends, relatives, or neighbours.

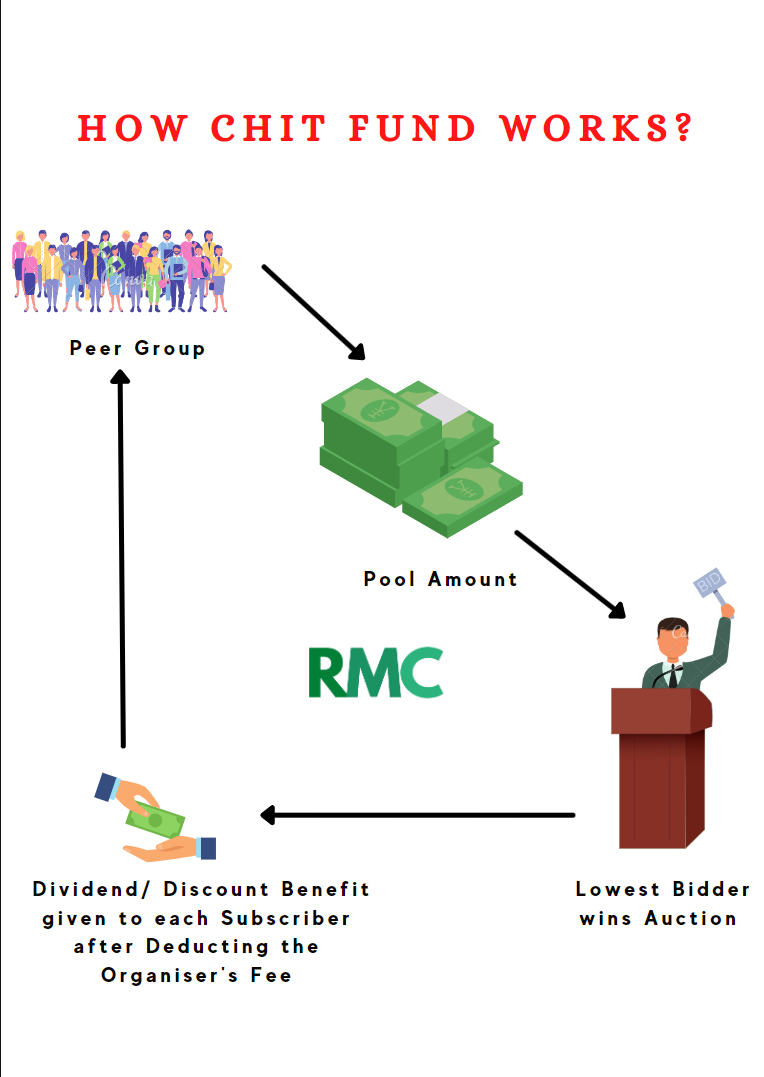

A Chit Fund is a savings borrowing scheme, in which a group of people enters into an agreement to contribute fixed deposits periodically, for a specific period of time. The amount so collected ( or the chit value ) is distributed among each of the persons in turns, which is determined by way of lots or an auction.

The Chit Fund company is a company that operates, conducts, or manages a chit scheme.

Chit Funds provide an opportunity to save some amount on a daily, weekly or monthly basis, and give easy access to it in case of contingency or any personal needs.

Benefits Of

Chit Funds

- Chit Funds offer you the advantage of saving as well as borrowing since the deposits made by all the subscribers are turned into a lump sum.

- It inculcates the habit of saving and setting apart a particular amount every month towards investment for a rainy day.

- Quick access to money since it’s easy to join a chit-fund scheme, and you can borrow the lump sum (the pot) by just paying the first installment.

- No questions will be asked, you don’t need to reveal the purpose of using the borrowed money. You can use it for marriage, shopping, travel, medical expenses, religious ceremonies, festivals, children’s education, business activities, etc.

- Chit Fund acts as a contingency. You can easily access the money to meet unexpected expenses, financial emergencies, or some personal needs.

- High dividend/ discount: The subscribers get a dividend that is comparatively higher than the interest accrued on the money saved in various deposit schemes.

- Low Interest: The subscribers mutually determine the interest rate, and it varies from auction to auction. Additionally, the interest rate of borrowing from the chit fund is comparatively lower than other forms of borrowing/ moneylenders.

- Intermediation cost is the lowest in the market.

- Exit Options with nominal changes.

- No periodic interest hikes.

Chit Fund Companies can be categorized as Registered and Non- Registered chit companies

Registered Vs Non Registered Chit Fund

Registered Chit Fund

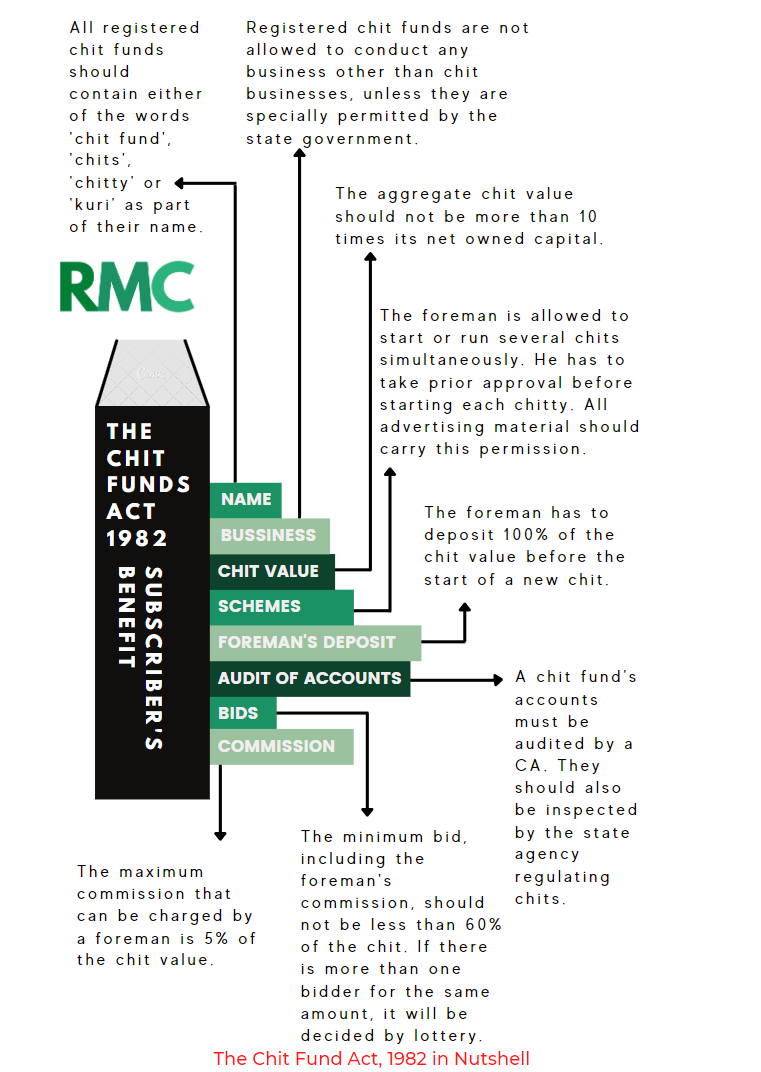

Respective State Government appoints the Registrar of Chits, who regulates the chit funds under The Chit Funds Act, 1982 and the rules framed under it.

It is always advisable for subscribers that in order to secure their investment, always go with the Registered Chit Fund Companies

Compliance Driven Approach - Secure

Since the financial health of the company can be tracked therefore it is more secure for investors and borrowers.

Monitored by Authority

Registered Chit Fund companies cannot deviate the funds for some other purpose other than the chit fund and are being monitored by the authority from time to time

Security Deposits

Security Deposits are with the government to protect the subscribers

Non-Registered Chit Fund

Unregistered chit funds are saving schemes that are operated among friends, family or colleagues.

Unorganized Structure - Less Secure

Because they are Non-Registered therefore it is seen that these businesses are running without Checks & Balances and No proper compliances are taken care.

Lack of Governing Body

In the absence of the governing body, No Compliances & No Audits by the government department hence financial health of the company can’t be tracked.

No Security Deposits

No Security Deposits with the government to protect the investors and the borrrowers.

Non-Registered were banned by Government

In 2019, the Banning of Unregulated Deposits Act was passed.

Non-Registered Chit Funds come under this category

हमारा चयन क्यों!

Why To Choose Us?

We are a Registered Chit Fund Company.

Our company was incorporated in May 2019, under the guidance of Shri Rakesh Sharma Ji, Director.

Our Mission – Even before the official launch of #VocalSeLocal in 2020 by our Honourable PM of India, we intended to support Indian Businesses, helping SMEs in arranging working capital at low rates and as early as possible, so that these businesses can grow, with them India’s unorganized sector can grow.

Registered Chit Fund Company

Registration No: 2827

CIN: U67100DL2019PTC35036

Compliance Always On Time

Regd. under the Chit Fund Act,1982 & Delhi Chit Fund Rules, 2007.

101% Safe

Bank FDs are being offered to the Registrar of the Delhi Chit Fund Department as chit security as per the Chit Fund Act, 1982.

Instant Prized Amount Payment

After subscriber wins the auction, the prized amount is instantly paid to them.

Customer Centric

Timely updates and follow ups for all the subscribers.

Transparent policies

All the policies are communicated to our subscribers timely that is amended by the Registrar Body.